FinDev Canada is Canada's development finance institution (DFI), supporting the private sector in developing markets to promote sustainable development.

In today’s increasingly complex world, development finance is needed more than ever to drive sustainable and inclusive economic growth. DFIs are an important tool in this regard, providing financial services aimed at growing the local private sector in developing countries.

Through our loans and investments, we look to mobilize private sector investment in developing markets to support business initiatives which enable gender equality, climate and nature action and market development, all under the banner of the United Nations’ Sustainable Development Goals.

Learn more about our development impact approach here.

We offer financial services such as investments, loans and guarantees. Additionally, through our Technical Assistance Facility, we help our clients become more proactive and inclusive agents in their respective markets. Learn more about our approach here and browse our portfolio here.

Learn more about FinDev Canada’s mandate and activities in our FAQ.

How FinDev Canada came to be

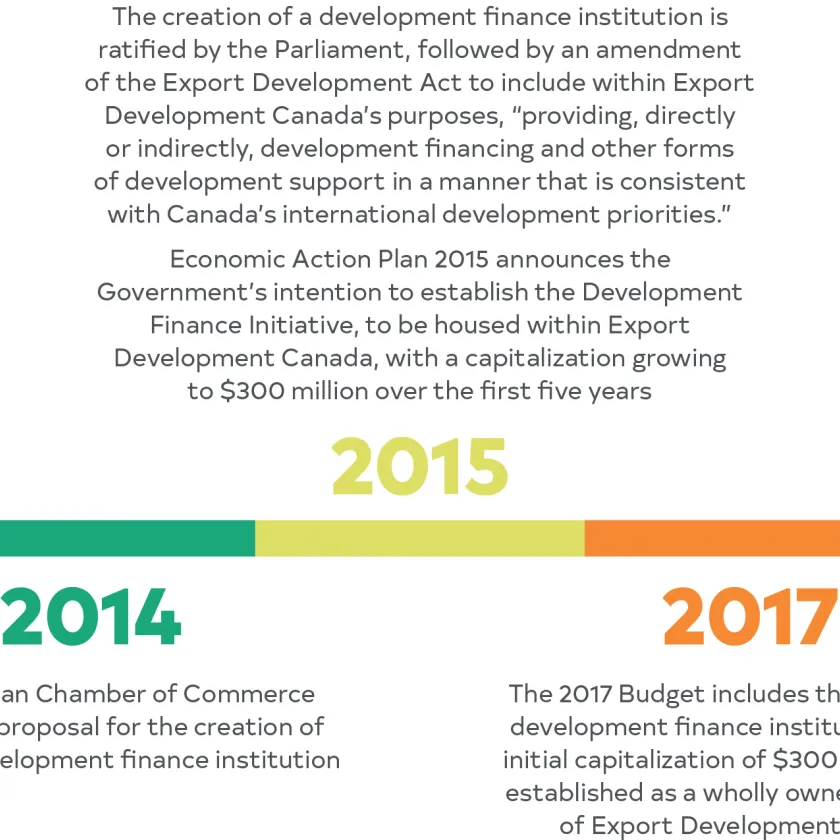

In January 2018, Canada’s development finance institution (Development Finance Institute Canada (DFIC) Inc. – or FinDev Canada) opened for business with a mandate to support the growth and sustainability of the private sector in developing markets. FinDev Canada promotes market development, climate and nature action, and gender equality.

Based in Montréal, FinDev Canada is a Crown Corporation and a wholly owned subsidiary of Export Development Canada (EDC), Canada’s export credit agency.