Mairead Lavery Chair of the FinDev Canada Board of Directors and CEO of Export Development Canada

Paul Lamontagne Managing Director

Our Foundational Year

During 2018, FinDev Canada started hiring talented individuals to conduct our business, growing to a team of nearly 20 people. We also put in place policies, procedures and systems for Canada’s new development finance institution (DFI), including a Development Impact Framework anchored around a gender lens, and named an Advisory Council and a Board of Directors composed of experts in international development, business and development finance to guide their actions.

We established partnerships with peers through the signature of Memoranda of Understanding with other DFIs, international finance institutions (IFIs) and multilateral development banks (MDBs) such as FMO, CDC, Finnfund and the African Development Bank. FinDev Canada also played a leading role in the launch of the 2X Challenge: Financing for Women, a commitment of the G7 DFIs to mobilize USD 3 billion toward projects that benefit women.

Finally, we signed two transactions in 2018, focused on green growth and women’s economic empowerment. Below, you can see the steps that led to these achievements:

During 2018, FinDev Canada grew to a team of almost 20 experts ready to tackle the multiple challenges behind investing with impact.

Development Finance Institute Canada announced on this date that Paul Lamontagne had been appointed managing director of the newly branded “FinDev Canada.”

FinDev Canada and the Canadian International Development Platform (CIDP) hosted a daylong conference with a wide range of development practitioners, development finance experts and other key stakeholders to discuss and deliberate key themes of interest for FinDev Canada and our stakeholders.

The Council guides and advises FinDev Canada in such areas as priority sectors and regions of activity, opportunities for innovative approaches to development finance, monitoring and evaluation, transparency, and in achieving its development impact goals.

FinDev Canada’s Development Impact Framework was open for stakeholder comments in May and June 2018, receiving more than 145 comments from over 30 different organizations and individuals. The organizations represented a range of stakeholder types, including non-governmental organizations/civil society, development finance institutions (DFIs) and impact investors, the private sector, academic and research institutions, and multilateral and government agencies.

FinDev Canada, along with DFIs from other G7 countries – the United Kingdom (CDC), the United States (Overseas Private Investment Corporation – OPIC), Italy (Cassa depositi e prestiti – CDP), France (Proparco) and Japan (JBIC and JICA), with support from Germany (DEG) – committed to mobilize USD 3 billion by 2020 for investment in business activities that will benefit women.

FinDev Canada hosted an international conference entitled “What could women do with USD 3 billion? Change the World.”

The Collaborative shares best practices and data focused on women’s economic empowerment.

Leaders of the two institutions signed an MoU at the first Africa Investment Forum.

The institutions committed to share best practices and knowledge and seek joint investment opportunities.

The investment will have a positive impact on climate change mitigation by avoiding 1.2 million tonnes of CO2 emissions.

The MoU covers co-operation in best practices, joint engagement opportunities and other means to contribute to the Sustainable Development Goals (SDGs).

The DFIs seek joint engagement opportunities and collaboration on best practices to contribute to the SDGs.

The investment will have a positive impact on climate change mitigation by avoiding 1.2 million tonnes of CO2 emissions.

Investments & Impact Reporting

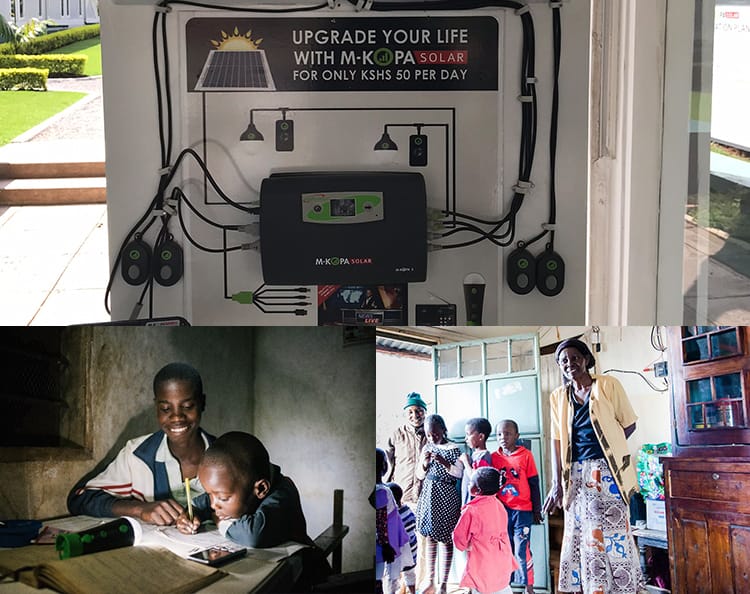

FinDev Canada successfully signed two transactions in 2018: a USD 10 million investment in the Kenya-based solar energy provider

M-KOPA Solar

The Impact Thesis

Environment and climate solutions

Surveys of

Women’s economic empowerment and market development

2018 Achievements

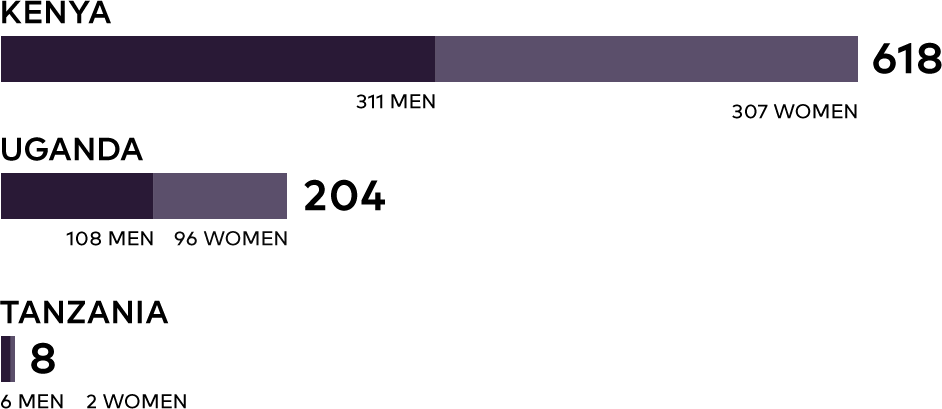

M-KOPA Staff as at 31/12/2018

The company also contributes to the local economy through payments of salaries and sales agent commissions, and payments to domestic suppliers and local maintenance providers.

Climate Investor One

Climate Investor One (CIO) is a 20-year investment fund launched in 2017 that focuses exclusively on renewable energy projects in emerging markets across Africa, Asia and Latin America. CIO will finance an estimated 20 small to mid-size onshore wind, solar PV, and run-of-river hydroelectric energy projects, each of which will typically range in size from 25–100 megawatts of power. CIO is managed by Climate Fund Managers (CFM), a Netherlands-based fund manager.

A first-of-its-kind blended finance approach for renewable energy, the unique structure enables CIO to bring renewable energy projects from the initial development stage through to construction and operations, and serves to mobilize a wide variety of funders including philanthropic agencies and multilateral donors, development finance institutions and commercial investors.

The Impact Thesis

Environment and climate solutions

CIO’s primary sustainable development contribution is to bring more renewable energy capacity to developing markets in a responsible and inclusive way. CIO’s projects will

install an estimated 1,100 megawatts of new power generation capacity, which will lead to ~3.2 gigawatt hours of additional renewable energy production per year by 2035. This new renewable energy production will contribute up to

1.2 million tonnes of avoided CO2 equivalent GHG emissions in emerging markets by 2035.

Women’s economic empowerment and market development

CIO’s inclusive and responsible approach to investment includes implementing a Gender and Social Inclusion Policy and associated Action Plan that will

position

the facility to incorporate best practices for gender equality at all levels of its operations, from the fund manager through to portfolio companies. This is expected to generate economic empowerment outcomes for women in areas

such

as governance, leadership and employment, and bolster their status as community members. The Fund’s activities will also generate construction and operational jobs and economic value-add through salaries, taxes and profits, each of

which will be tracked throughout the life of the investments.

2018 Achievements

In 2018, CIO successfully began its investment operations: in September, the Fund invested in Cleantech Solar Asia Pte Ltd., a leading Pan-Asian rooftop solar developer, owner and operator offering full-service solutions to corporate clients. The CIO investment will be used to finance the construction of an additional 60 megawatts of new off-grid Corporate and Industrial (C&I) solar generation. CIO’s participation will also enable Cleantech to build out its pipeline of future projects across the region. Over the lifetime of the investment, CFM estimates that Cleantech will produce ~636 gigawatts of energy, avoid ~475,000 tonnes of CO2 equivalent emissions, and serve more than 500,000 people with clean energy.

The facility also advanced its active roster of renewable energy projects, with 10 projects receiving approval to move to the development phase of financing. The 10 approved projects total over 500 megawatts of installed power, nearly 80% of which is approved for countries in Africa.

Financial Reporting

FinDev Canada is committed to transparency about its operations, strategies and policies. Below you can find FinDev Canada’s 2018 Financial Statements.