By Charles Benoit, Climate Impact Officer at FinDev Canada

Source: PCAF (2020). The Global GHG Accounting and Reporting Standard for the Financial Industry. First edition. P. 19-20.

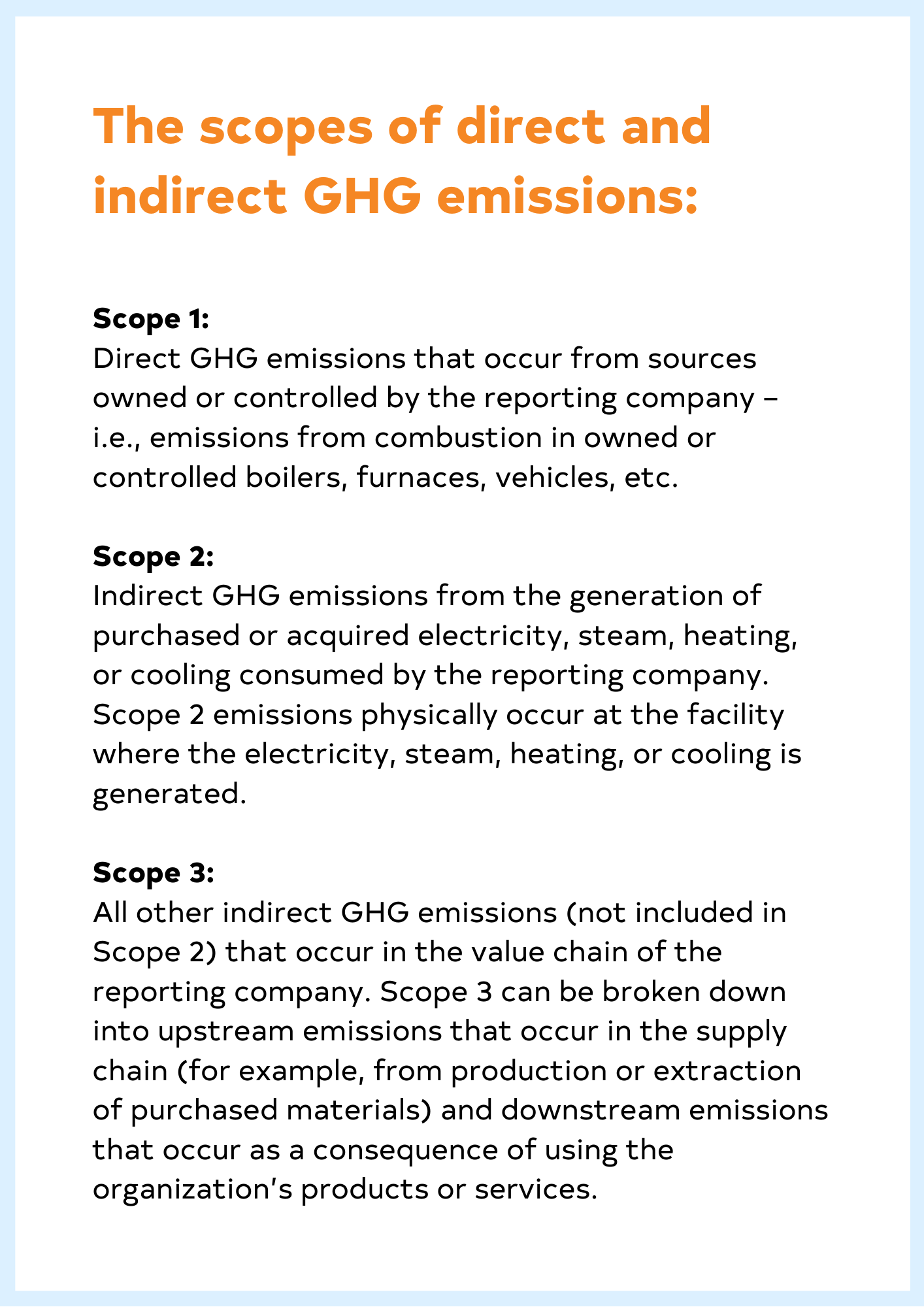

While financial institutions directly produce very limited amounts of greenhouse gas (GHG) emissions, their financed emissions, which are associated with their investing and lending activities, are usually 100 to 1,000 times more important than their operational emission, or scope 1 and 2 in the carbon accounting jargon.[1] However, until recently, there was no globally recognized standard or methodology to calculate these financed emissions.

This changed in November 2020, when the Partnership for Carbon Accounting Financials (PCAF) released the The Global GHG Accounting and Reporting Standard for the Financial Industry. With the “Built on Greenhouse Gas Protocol” mark, this standard is becoming the global reference for measuring financed GHG emissions. It was launched after a public consultation including financial institutions, policy makers, data providers and civil society organizations.

The PCAF standard enables financial institutions to measure and disclose the GHG emissions financed by their loans and investments. Standardizing carbon accounting is essential for financial institutions to align their portfolio with the objectives of the Paris Climate Agreement - to keep temperature rise below 2°C by 2100, and ideally below 1.5°C. The PCAF standard enables financial institutions to report on emissions transparently, on a comparable basis, which is critical to scale sustainable finance.

On March 22, 2021, we joined more than 100 leading financial institutions that are already part of PCAF and committed to measure and disclose the GHG emissions associated with our loans and investments.

Why do we support PCAF?

FinDev Canada has been committed to climate action since our launch in 2018. Climate mitigation and adaptation is one of our three development impact goals and plays a key role in the realization of our mandate. We recognize that FinDev Canada’s financed emissions are much higher than our scope 1 and 2 operational emissions, especially as our head office is powered by renewable electricity. Other sources of scope 3 GHG emissions, such as business travel, also represent a fraction of our financed emissions.

This is why we are committed to measuring and disclosing the GHG emissions associated with our portfolio of loans and investments in line with the PCAF standard. Better understanding the climate impact of our investment activities is a first step to align our portfolio with the Paris Climate Agreement and collectively reach net-zero emissions by 2050.

Beyond committing to measure and disclose our financed emissions, we also support climate solutions by investing in renewable energy (Climate Investor One, JCM Power, CIFI) and off-grid energy (M-KOPA Solar) companies. These investments contribute to significant avoided GHG emissions by displacing fossil fuel-based energy sources. We also support forestry companies in Sub-Saharan Africa (Miro Forestry, Africa Forestry Fund II). Their forest plantations also contribute to climate change mitigation by removing carbon from the atmosphere.

How does PCAF fit in FinDev Canada’s development impact approach?

Our support for PCAF is well aligned with FinDev Canada’s impact measurement and reporting approach. PCAF is a collaboration between financial institutions worldwide to enable harmonized assessments and disclosures of GHG emissions financed by loans and investments. We are joining a growing number of financial institutions that have also signed the PCAF commitment letter, including other development finance institutions (DFIs) such as CDC Group from the UK and FMO from the Netherlands, some of our clients such as FirstRand Bank and Produbanco, and Canada’s leading financial institutions (BMO, CIBC, Desjardins, Royal Bank, Scotiabank, TD Bank and Vancity). Together we will continue collaborating to promote transparency and uniformity in carbon accounting.

Our support for PCAF is also aligned with FinDev Canada’s implementation of the Operating Principles for Impact Management (the Impact Principles). In April 2019, FinDev Canada was among the first to sign the Impact Principles, which provide a framework for investors to ensure that impact considerations are purposefully integrated throughout the investment life cycle. The PCAF standard provides a globally recognized framework to assess the impact of each investment in terms of GHG emissions and monitor progress over time.

Finally, we are also collaborating with development financial institutions in the development of the Joint-Impact Model (JIM) in alignment with our commitment to PCAF. The JIM is designed to help investors measure and report on indirect impacts of loans and investments, including financed GHG emissions. For investees that do not measure their GHG emissions, the JIM is a powerful tool in estimating these emissions in line with the PCAF Standard.

[1] The Economist (2020). Making sense of banks’ climate targets