The Technical Assistance Facility (TAF) complements FinDev Canada’s investment activities and advances our development impact objectives. The TAF (a) strengthens our private sector clients, making them more proactive and inclusive agents in their respective markets; and (b) advances market-level initiatives which address broader constraints to inclusive and sustainable economic growth.

2022 Annual Report

2022 Annual Report

FinDev Canada | 2022 Annual Report

FinDev Canada | 2022 Annual Report

Growth with

purpose

As Canada’s bilateral development finance institution (DFI), FinDev Canada is focused on supporting sustainable development through the private sector in alignment with the Sustainable Development Goals (SDGs) and Paris Agreement commitments. To support this objective, in 2022 the corporation launched a refreshed corporate strategy, the purpose of which is to enable FinDev Canada to scale its operations and grow its impact in the development finance space.

2022 Highlights

Investment updates and

featured transactions

2022 clients

Cooprogreso (II)

Cooprogreso is a leading financial cooperative in Ecuador providing access to financial services to low-income customers through programs that target people with limited or no access to finance. Their financial offering includes small business loans and medical insurance programs.

Banco Nacional de Costa Rica (BNCR)

BNCR is a financial conglomerate wholly owned by the government and the largest commercial bank in the country in terms of assets and portfolio management. BNCR is a key institution in the economic development of Costa Rica.

Banco de Occidente

Banco de Occidente is the sixth largest commercial bank by total assets in Colombia and is part of Grupo Aval, the largest financial conglomerate in the country. As a leading provider of financing to small and medium enterprises, Banco de Occidente plays an important role in advancing economic development, access to financial services and business growth in Colombia.

Locfund Next

Locfund Next is a microfinance investment vehicle focused on financial inclusion by supporting smaller microfinance institutions in Latin America and the Caribbean. The fund, launched in 2020, is managed by Bolivian Investment Management, part of the Panamerican Group.

Export Trading Group (ETG) (II)

ETG is one of the largest agricultural trading companies in Africa and a key player in several value chains in more than 20 countries across Sub-Saharan Africa. They focus on growing food supply and agricultural exports in the region.

Miro Forestry (II)

Miro is a West African leading integrated forestry and timber enterprise. They plant a mix of fast‑growing trees and process the wood flow into products from fast‑growing, high‑yield, FSC‑certified trees for both local and international markets.

Adenia Capital

Established in 2002, Adenia Partners Limited will manage Adenia Capital V L.P., a Pan-African private equity fund which will provide financing and professional support for the inclusive and sustainable growth of African mid-cap businesses.

Market development

Market development

Women’s economic empowerment

Women’s economic empowerment

Climate action

Climate action

FinDev Canada’s

portfolio dashboard

-

New commitments -

Equity vs. debt -

Oda country split -

By sector -

By development impact goal -

By Geographical focus -

2x qualification -

Impact reported by clients

1 Based on active commitments. Total commitments since inception, including repayments or exits, are USD 658M.

2 The Official Development Assistance (ODA) classification is based on the Organisation for Economic Co-operation and Development (OECD) Development Assistance Committee (DAC) List of ODA Recipients. The list groups countries, according to their gross national income (GNI per capita in current USD) following the World Bank’s income classification as “low-income economies”, “lower-middle-income economies”, and “upper-middle-income economies”, while taking into account the United Nations (UN) classification of some countries as “Least Developed Countries” (LDCs). For details, see the 2022–2023 DAC List of ODA Recipients.

3 2X-qualified capital represents 66% of our total commitments to-date, totaling USD 423M across 27 clients. Given a considerable portion of financial institutions and funds in our portfolio, our clients typically qualified on several 2X criteria (the most common ones being leadership, employment and indirect criteria for financial intermediaries).

At-a-Glance

2022 Projects

Banco Nacional de Costa Rica (BNCR)

Objectives

BNCR is a state-owned bank and the largest in the country. Our TA project is supporting the bank to develop a targeted strategy to better serve women customers, in addition to training and coaching for the bank’s staff.

Cooperativa Pacifico

Objectives

Cooperativa Pacifico is Peru’s largest financial cooperative. This TA project is supporting the client to implement key elements of their gender action strategy, including staff training on gender equality and biases; review and development of HR and communications policies; and market research to support the product development team to pilot new products and services for women clients.

Danper Peru

Objectives

Danper Peru is a woman-led agribusiness that produces high-value crops for export. This TA project is enabling Danper to create an easy-to-use tool to measure carbon sequestration in order to more accurately reflect the company’s total emissions. Danper employees will be trained on how to use the tool so it can be applied across the company. This is the TAF’s first climate action project.

PC Capital

Objectives

PC Capital is a leading investment banking and private equity firm in Mexico, focused on high-growth social impact opportunities. This TA project includes activities which aim to integrate a more advanced environmental and social (E&S) and gender lens in the client’s activities. Training will ensure that there is internal capacity to sustain the efforts.

Phatisa Food Fund 2

Objectives

Phatisa Food Fund 2 (PFF2) invests in businesses in Sub-Saharan Africa that are driving inclusive development in the food value chain. PFF2 established a TAF to push the needle on the fund’s overall impact thesis by supporting portfolio companies on innovative and inclusive business models. The TAF will also conduct research on relevant topics for the benefit of the broader sector. Four DFI Limited Partners of the fund, including FinDev Canada, have collaborated to launch this TAF, by way of TA grants to the fund.

Produbanco

Objectives

Produbanco is Ecuador’s third largest bank, with a focus on small and medium-sized enterprises (SMEs), corporations and individual clients. Over the last five-plus years, Produbanco has deepened its focus on sustainability by designing specific credit products which fall under the category. This TA project is enabling the bank to pilot a UNDP-designed business development services program with selected SME clients, and also providing training to internal staff so that the program can be scaled across the portfolio.

Maranatha Solar

Objectives

This TA project is associated with a solar energy project currently in the pre-construction stage. Technical assistance support will be used to influence and expand the solar project’s impact objectives from the outset by: (a) conducting E&S impact assessments and developing an E&S management system in line with the IFC Performance Standards; and (b) embedding gender-smart practices within the project’s operations. This is the TAF’s first pre-investment project.

Climate Policy Initiative (CPI)

Objectives

CPI is a leader in the climate change policy and finance space and also houses the Global Innovation Lab for Climate Finance (the Lab). Over the last eight years, the Lab has successfully launched over 60 financial instruments (including one that is a client of FinDev Canada – Climate Investor One) on themes such as Renewable Energy Access, Sustainable Food Systems and Sustainable Cities. The partnership between FinDev Canada and CPI is facilitating the launch of a Gender Equality stream, which will specifically identify and develop a financial instrument at the gender–climate nexus.

Joint Impact Model (JIM)

Objectives

The JIM was established in 2019 when six DFIs came together to develop a publicly accessible tool that enables the reporting and assessment of systemic impact indicators such as jobs created, economic value added and greenhouse gas (GHG) emissions. As a founding partner, FinDev Canada has supported the evolution of the JIM since 2019, including the development of the Partnership for Carbon Accounting Financials (PCAF) module. Through another TA project, FinDev Canada is partnering with the JIM and other DFIs to pilot the PCAF tool with financial institutions (including one from our portfolio) with net-zero strategies.

Business performance

Business performance

Gender action

Gender action

Impactful data

Impactful data

In 2022, FinDev Canada continued to leverage partnerships to build expertise, share learnings, increase effectiveness and identify impactful investment opportunities. A summary of ongoing partnerships, engagements and memberships is available here. Below are some highlights from 2022.

Government of Canada

As Canada’s bilateral DFI, FinDev Canada contributes towards Canada’s international development and climate finance objectives. Through 2X Canada – a CAD 75.9 million blended finance facility funded through Global Affairs Canada – FinDev Canada is supporting private sector growth and investment in priority markets to positively impact women’s economic empowerment in COVID-19 recovery. Learn more about 2X Canada.

Adaptation & Resilience Investors Collaborative (ARIC)

In 2021, FinDev Canada joined ARIC, an international partnership of DFIs working together to accelerate and scale up private investment in climate adaptation and resilience in developing countries. To unlock investment in climate adaptation and resilience, we build know-how, tools and join forces to develop pipelines of bankable investments.

2X Global

The 2X Challenge was initially launched in Canada at the 2018 G7 Summit, with FinDev Canada among its inaugural members. Today, it has expanded into 2X Global, a global membership and field-building organization for investors, capital providers and intermediaries working in public and private markets across both developed and emerging economies.

Canada Forum for Impact Investment and Development (CAFIID)

Through its support of CAFIID, FinDev Canada aims to advance Canada’s contribution to impact investing in emerging and developing markets by strengthening the Canadian ecosystem and by fostering collaboration, learning and knowledge sharing.

Operating Principles for Impact Management

FinDev Canada is a founding signatory of the Operating Principles for Impact Management (the Impact Principles), a framework for investors to ensure that impact considerations are purposefully integrated throughout the investment life cycle. In 2022, FinDev Canada issued its annual Disclosure Statement affirming that our investments continue to be managed in alignment with the Impact Principles.

Women comprise*: As of December 31, 2022

Visible minorities represent*:

Parity Certification

EDC and FinDev Canada once again received a Gold Certification as a result of the gender assessment conducted by Women in Governance in 2022. This reflects the organizations’ commitment to women’s economic empowerment, as well as the calibre of their gender practices, strategies, policies and programs. More details about the certification process can be found here.

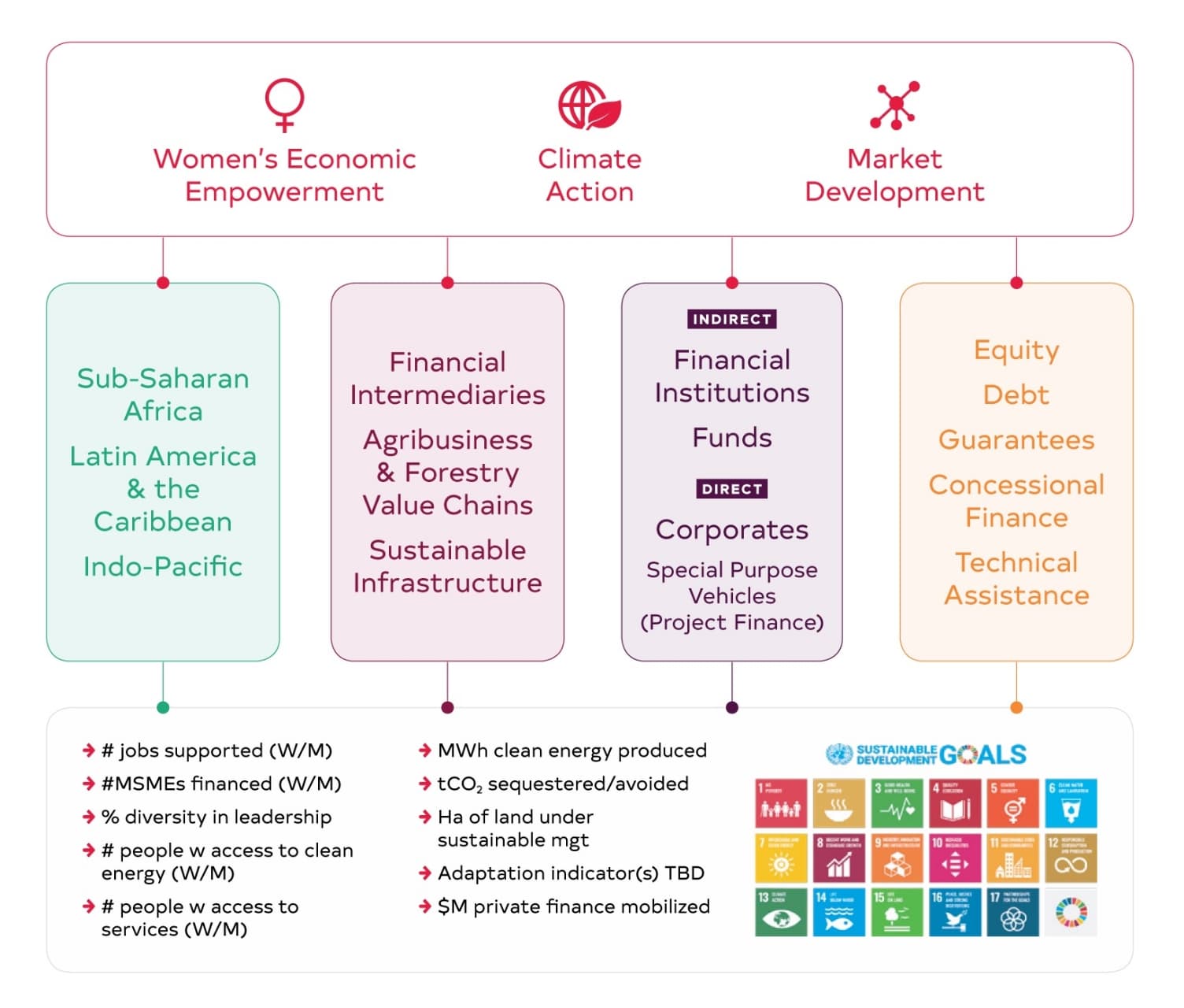

In 2022, FinDev Canada initiated a long-term strategy refresh exercise to position the corporation for future growth and success as Canada’s DFI. That strategy is reflected in the 2023–2027 Corporate Plan and depicted in the diagram below.

This strategy is aimed at recognizing where we started. Four years ago, FinDev Canada opened its doors. We built our company and our reputation as a niche institution, agile and innovative. We were successful and built a platform from which we could grow our impact in the markets we serve.

Fast forward to the end of 2022 and we have a portfolio of over CAD 638 million and 35 clients. We have built strong partnerships in Latin America and the Caribbean, and Sub-Saharan Africa. Most recently, the Government of Canada has given us greater responsibility and is investing in us so we can expand into the Indo-Pacific region.

While we have been building our business, development gaps have grown around the world. We know that developing countries face at least a USD 4 trillion annual SDG investment gap. We see evidence every day that the climate crisis is worsening. As the pandemic recedes, we see how COVID-19 has rolled back advancements in many areas, including related to gender and equality. Finally, we see how global conflicts – in Ukraine and elsewhere – have exacerbated food security challenges.

When we cast our eyes forward to envision the next five years of FinDev Canada, that was our context. The platform we have built juxtaposed against a world facing growing and more complex development challenges. Accordingly, we built a strategy with the objective of positioning FinDev Canada to both build on its success and grow its impact into the full breadth and potential our incredible mandate offers. A strategy that enables us to do our part to tackle these challenges head on and work with the private sector to enable growth with purpose, all in alignment with Canada’s international development objectives.

-

+–Governance Report

In 2022, FinDev Canada continued its efforts over the past year to implement and strengthen its governance practices, policy framework and processes across all areas of activity of the organization. More details in the PDF report.

-

+–Financial Statements

In 2022, FinDev Canada’s net financing and investment income of CAD $19.1 million was CAD 2.4 million higher than anticipated in its Corporate Plan. Net income for the year was CAD $4.5 million. Total assets were CAD 586.2 million, CAD 193.0 million higher than December 2021, primarily due to growth within our loan and equity investment portfolios. More details in the PDF statements.

-

+–TCFD Disclosure

FinDev Canada is committed to progressively implementing the TCFD recommendations and reporting on progress, including through its TCFD disclosure, which summarizes FinDev Canada’s current climate change practices that will continue to evolve to meet the TCFD recommendations.

-

+–Full Annual Report

Consult the full 2022 Annual Report in PDF format.

This refreshed strategy – premised on the recognition that development challenges are growing internationally – positions FinDev Canada to build on its strong platform of success in its existing markets of focus and expand into the Indo-Pacific region in support of Canada’s broader strategy for the region.

By leveraging its suite of investment, financing and blended finance solutions, in addition to its technical assistance offering, FinDev Canada is well positioned to support sustainable and inclusive growth in three ways:

Building low-carbon and climate-resilient economies, including through sustainable infrastructure;

Developing markets to support quality job creation and access to finance, products and services that enhance living standards and add value to local and regional economies; and

Mainstreaming gender equality to support women’s economic empowerment, reduce inequalities and drive business performance.

The intent and impact of this strategy are reflected in the corporation’s results for 2022, which saw it expand its business, and by extension its impact, in Latin America and the Caribbean, and in Sub-Saharan Africa.