FinDev Canada offers Technical Assistance (TA) and advisory, through grants and advisory services, to support its clients and other market players to improve development impact outcomes. TA is a valuable tool to complement financing and investment activities and foster more holistic relationships with clients and relevant market players.

The TA Facility plays a key role in the delivery of our mandate, to support a more inclusive and resilient private sector in emerging markets and developing economies, aligned with the Sustainable Development Goals (SDGs) and Paris Agreement commitments. Given the markets in which we operate, our development impact priorities – climate and nature action, gender equality, and market development – are often challenging to attain and are also associated with implementation risks. TA offers targeted support to our clients, and other private sector entities and market level stakeholders, to build the capabilities necessary to address these priorities.

What We Do

FinDev Canada’s TA Facility undertakes projects at both client and market levels.

- Client-level: Successful client-level TA projects enable our clients to dedicate resources towards prioritized activities (in the focus areas described below), gain first-hand implementation experience and thereby, understand the business case for continued efforts. TA projects support clients to accelerate relevant capabilities, leverage the expertise of FinDev Canada staff, and overall, build the foundations necessary for continued progress on impact, E&S risk management, and other business areas.

- Market-level: Successful market-level TA projects enable FinDev Canada to lead on and contribute to the development finance ecosystem by building tools, training, and other resources; filling knowledge gaps; supporting innovation; and collaborating with peers. In turn, these initiatives support our clients and other private sector entities to adopt practices aligned to global standards.

Focus Areas

The Technical Assistance Facility has four focus areas:

| Gender Action: The TA Facility supports projects that advance gender inclusion and diversity practices. Our Gender Action TA Menu outlines strategic areas where we support our clients in reaching their gender equality commitments. We offer sector-specific and sector-agnostic interventions, enabling our clients to build capabilities in line with the 2X Challenge criteria. |

| Climate and Nature Action: The TA Facility is committed to supporting clients to integrate climate-related risks and opportunities into their business operations, thereby enhancing their climate mitigation, adaptation, and resilience outcomes. Our Climate and Nature Action TA Menu provides a holistic set of interventions to support our clients in reaching their climate and nature action commitments. |

| Business Performance: More generally, we work to strengthen selected business functions within companies to enable them to align with global best practices. This can include improvements to environmental and social risk management systems, human resources management, and digital capabilities. |

| Impactful Data: We support clients in establishing systems and capabilities for the strategic collection and analysis of data. In addition, we support market-level initiatives that advance data-driven impact investment practices such as models for consistent impact measurement and training toolkits. |

Market level engagements cut across all our focus areas and are aimed at strengthening the development finance ecosystem.

Start of Gender Action TA Menu Diagram

Start of Climate and Nature Action TA Menu Diagram

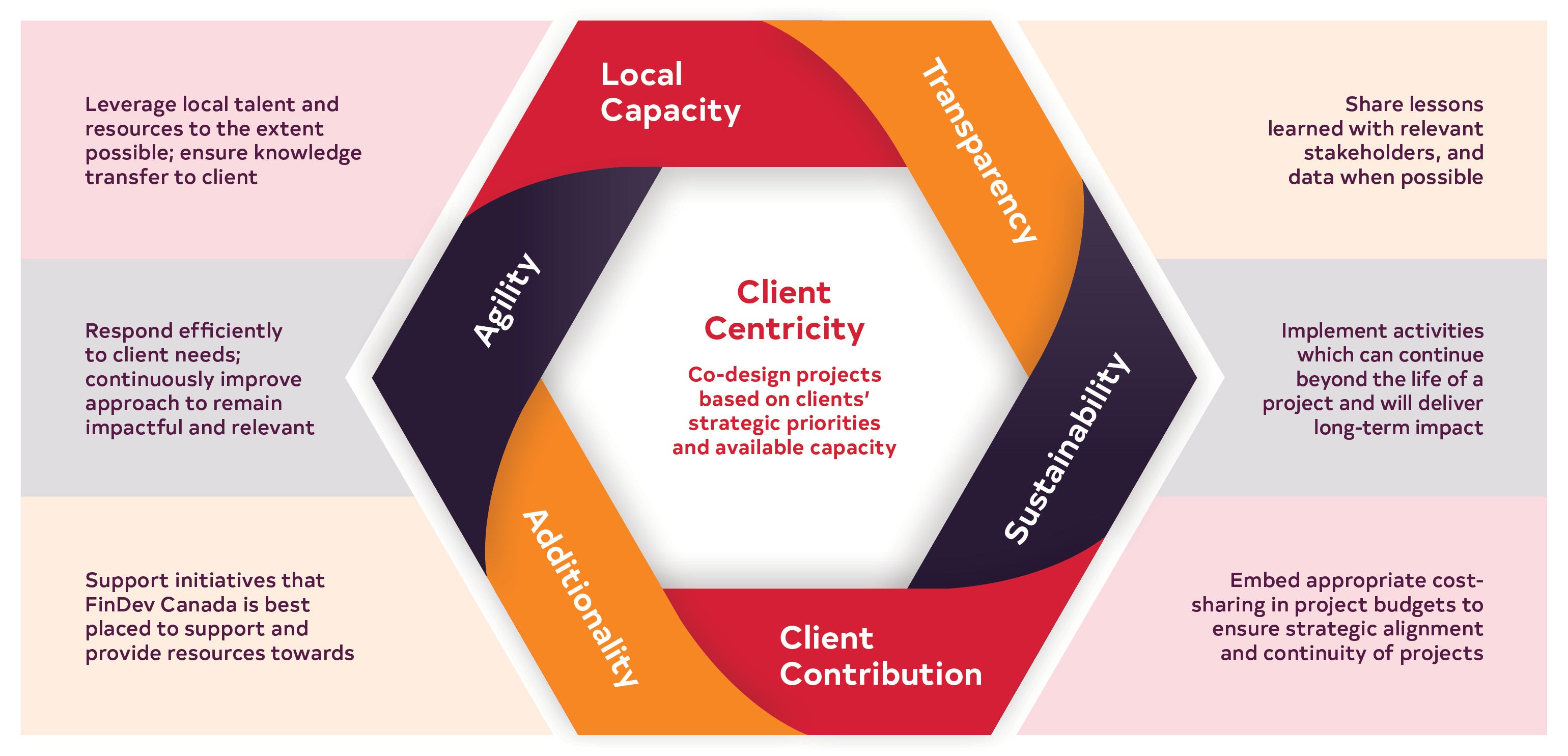

How We Work

The following principles guide TA projects’ design and implementation:

TA Portfolio Overview

Figures as of October 2024.

TA Portfolio

Alitheia IDF Fund

Strengthen the fund manager’s foundations, both in terms of how it conducts investment activities, and how it supports portfolio companies through growth and exits, specifically in climate and E&S risk management areas.

Africa Forestry Fund II

Equip the fund manager to deliver gender action advisory to selected portfolio companies and disseminate insights within the forestry and other relevant sectors.

AVLA Peru

Support AVLA's diversity and inclusion strategy through the implementation of a mentorship program for women leaders, the delivery of a series of virtual customer engagement events enabling AVLA to connect with current and potential clients in a meaningful manner, and offering the targeted women access to information which can support their business growth.

Banco Nacional de Costa Rica (BNCR)

Enable BNCR to develop a targeted strategy to serve the women micro, small and medium-sized enterprise (MSME) segment through market research, the launch of a mentorship and training program for women leaders and training the salesforce and senior leaders on gender inclusion.

Banco Sofisa

Ensure a strong Gender, Diversity, and Inclusion component within the bank’s Sustainable Finance strategy. This includes identifying and piloting financial and non-financial products and services for women small and medium-sized enterprise (SME) clients.

Bolivian Investment Management (BIM)

Enable BIM to strengthen their operations as a fund manager, helping the fund to meet its targets in the context of a growing portfolio through an assessment of BIM’s current currency hedging approaches, as well as review BIM’s risk management policies to identify areas of improvement and align with best practices.

Climate Fund Managers

Formalize the fund manager’s approaches for delivering Gender Equality and Social Inclusion (GESI) advisory to portfolio companies.

Cooperativa Pacifico

Advance the implementation of Cooperativa Pacifico’s gender action plan through comprehensive staff training on gender equality and biases across sales, communications, and HR teams, a review and development of HR and communications policies, as well as market research and focus group discussions with women customers to pilot new products and services.

Cooprogreso

Support Cooprogreso to better serve women agri-entrepreneur clients.

Danper Peru

Develop a tool to measure carbon sequestration of Danper’s agricultural fields, and identify recommendations for further emissions reductions, to support the client towards their net-zero target.

EcoEnterprises Fund III

Enhance EcoEnterprises Fund III’s E&S risk management capabilities, aligning them with global best practices, and enable the fund manager to extend targeted advisory services to portfolio companies, specifically on gender and climate action.

Export Trading Group (ETG)

Support ETG to assess deforestation levels, as well as gender and social risks, in five key agricultural supply chains across nine countries, by undertaking a baseline data collection exercise. This will ultimately help ETG to ensure the reliability of its supply chains while meeting environmental and social regulations in its markets.

JCM Power Corp

Support JCM to develop and execute a corporate-level gender action plan, as well as conduct GBVH-specific assessments and training with two project companies in Africa and Asia.

Maranatha Energy Investment

Support the solar project proponent to enhance their E&S policies, frameworks, and procedures, as well as incorporate gender best practices in their operations.

MFX Solutions Inc.

Review MFX’s impact to date, specifically in the microfinance sector, and assess opportunities in sectors with less exposure.

Phatisa Food Fund 2

Contribute to Phatisa Food Fund 2’s TA Facility which supports portfolio companies to expand on their innovative and inclusive business models. The Facility will also conduct research on relevant topics for the benefit of the broader sector.

Miro Forestry

Strengthen Miro’s human resource policies and practices to create a gender-inclusive, safe, and productive workplace environment.

PC Capital

Integrate more advanced gender and E&S risk management approaches in the fund manager’s operations.

Produbanco

Support Produbanco to pilot a business development services program with selected small and medium-sized enterprise (SME) clients to strengthen their businesses, and in turn, position them to become higher profile customers. The pilot, together with training to internal staff, demonstrated the business case for non-financial services and equip the bank to scale such services.

Climate Policy Initiative

- 2022 project: Launch a Gender Equality stream within CPI’s Global Innovation Lab on Climate Finance, to identify and work with a gender-responsive climate finance instrument.

- 2024 project: Provide gender specific technical assistance to selected current and past proponents of CPI’s Global Innovation Lab on Climate Finance. Advance thought leadership in the gender-climate and gender-nature nexus topic areas.

Criterion Institute

Develop a roadmap to guide DFIs on how to reduce gender-based violence (GBV) in a consistent and step-by-step manner through their private sector clients.

Energy Entrepreneurs Growth Fund (EEGF)

Support the fund manager to provide portfolio companies with core business support and specialized capacity building. The Fund will also conduct a study to understand how access to energy contributes towards women’s economic empowerment.

Invest2Impact

Identify 100 high-potential women entrepreneurs in East Africa through a business competition and build capabilities around investment readiness and adaptation for COVID-19.

Joint Impact Model

2020, 2021, and 2023 partnerships: Collaboration across several DFIs and other investors to develop a harmonized model for reporting on systemic impact indicators, including reporting on the Partnership for Carbon Accounting (PCAF) standards.

Solar Supply Chain Working Group

2022 and 2023 partnerships: Collaboration across several DFIs to develop and test tools and resources for deeper due diligence into potential human rights violations and labour risks within supply chains for solar PVs and related products.

UN Women – Lelapa

Workshop with women-led fund managers and DFIs to identify challenges related to investing with a gender lens, specifically within the context of African small and medium-sized enterprises (SMEs).

2X Plus Taskforce

Development of a framework for DFIs to integrate intersectionality in gender lens investing.

2X Fund Manager Training Development and Delivery

- 2020 project: Development and pilot of FinDev Canada’s training toolkit to support fund managers and investment professionals expand their capabilities on gender lens investing.

- 2023 project: Update of FinDev Canada’s 2X Fund Manager training toolkit in light of the new 2X Criteria, and in-person delivery with select fund manager clients, as well as strategic market-level events.

FAQ

What is Technical Assistance?

Technical Assistance is targeted grant support to private sector clients that, directly or indirectly, improves their development outcomes. TA at the market level addresses gaps in knowledge or tools and seeks to support the business environments in the countries, regions, or sectors in which we operate.

The Global Impact Investing Network (GIIN) defines TA as:

Capacity-building is a versatile, widely applicable tool that offers direct benefits to both investors and investees. It addresses a range of needs, including human resources development; impact targeting, measurement, and reporting; and technical and/or specialized support. When applied well, it improves investor competitiveness, enhances business performance of investees, expands impact for beneficiaries, and strengthens markets and sectors.

— GIIN, Beyond Investment: The Power of Capacity Building Support, 2017

What are some examples of TA projects?

TA projects with financial institutions, for example, often include the following activities:

• Market research and customer engagement (e.g., focus group discussions) to develop better understanding of demand

• Design, review, and piloting of financial and non-financial products to expand outreach to targeted customer segments, and assess financial sustainability

• Enhanced customer outreach through digital platforms and other marketing strategies

• Staff training, leadership coaching

• Design and roll-out of inclusive policies at the level of the financial institution

For examples of other TA projects, please see the Portfolio section above.

How does FinDev Canada originate TA projects?

Client-level TA projects are identified with internal deals teams and through discussions with clients. Market-level TA projects are often led by FinDev Canada independently, or in partnership with peers and other stakeholders in the development finance ecosystem.

Projects must occur in FinDev Canada’s priority investment areas. This means projects in the private sector in Latin America & the Caribbean, Sub-Saharan Africa, and the Indo-Pacific region across our three sectors: agribusiness, forestry and their related value chains, the financial industry, and sustainable infrastructure. Projects must also fall under at least one of the Technical Assistance Facility’s four focus areas of gender action, climate and nature action, business performance, and impactful data.

Individual TA project proposals are assessed against our guiding principles, including, client demand and readiness, the TA Facility’s additionality, potential to achieve the targeted objectives and sustain them beyond the life of the TA project, and the potential to extract learnings. Market-level TA projects will be prioritized based on alignment with FinDev Canada’s overarching strategy and priorities within the development finance ecosystem.

For client-facing TA projects, does FinDev Canada engage with clients before or after the signing of a transaction?

While potential scope of a TA project may be discussed prior to the signing of a transaction, in most cases, TA projects are approved and implemented after signing.

How is the TA Facility governed and managed?

The TA Facility sits within the Impact Enablement team at FinDev Canada. A Technical Assistance Committee, comprised of FinDev Canada leadership and external experts, approves projects and provides strategic guidance in a regular cadence.

Who delivers technical assistance?

Projects are implemented by clients and partners through a combination of internal resources, and external consultants or service providers, with FinDev Canada providing advisory guidance. FinDev Canada encourages clients and partners to work with local and regional service providers.

How can service providers or consultants specializing in one or more of FinDev Canada’s Technical Assistance priority areas work with the TA Facility?

If you are a consultant and would like to be included in our database, please send us a brief email with the following information:

• Business name

• Website

• Regions and countries served

• Areas of expertise (e.g., gender, climate, E&S risk management)

• Sectors served (e.g., financial services, infrastructure)

• Services offered (e.g., strategy development, TA to portfolio companies)

• Language(s) of service

• Primary contact name, position, email

Please note that inclusion in our database does not constitute a guarantee of work.

What is the best way to contact FinDev Canada’s Technical Assistance Facility?

If you are a current client, please speak with your designated FinDev Canada Investment/Deal team colleague. Otherwise, please send an email to: info@findevcanada.ca