By Stephanie Shumsky, Senior Advisor, Environmental and Social Risks at FinDev Canada

As the COVID-19 pandemic begins to subside in many countries around the world, and governments transition away from emergency response to longer-term economic stimulus measures, a key question for policy makers is emerging: How can we #BuildBackBetter? How can we turn this crisis into an opportunity?

There are enormous possibilities to establish the “new normal” both from an environmental and social standpoint. Although losses and disruptions have occurred related to health, economic and social spheres, COVID-19 has also opened the door for making some long-awaited changes. The role of investors in this transition is an important one and will involve aligning strategy and active ownership with sustainable development.

In a recent Policy Response to Coronavirus document[i], the OECD outlined five key dimensions for “building back better,” including:

- Aligning with net-zero GHG emissions

- Strengthening climate resilience

- Reducing biodiversity loss

- Innovation building on behaviour changes

- Improving supply chain resilience and circularity.

Below we look at some of these facets and how FinDev Canada’s approach is contributing to “Build Back Better.”

Covid-19 impact on GHG emissions

Following major lockdowns around the world, daily global CO2 emissions decreased by –17% by early April 2020 compared to 2019 levels, with almost half of these changes coming from reductions in ground transportation, like cars and trucks.[ii]

However, during previous economic crises, GHG emissions reductions have been short lived, with a post crisis rebound that usually brings emissions back to the original levels. For example, the 2008–2009 Global Financial Crisis saw global CO2 emissions decline by –1.4% in 2009 but was immediately followed by a growth in emissions of +5.1% the next year, which kept the planet on the same climate disrupting emissions pattern almost as if the crisis had not occurred. [Ibid]

Now, we have an important opportunity to align economic stimulus packages with zero-carbon, climate-resilient, and renewable-focused systems, to support the acceleration of the transition to a zero-carbon economy and put our planet on a more resilient climate trajectory.

Even before the COVID-19 crisis, FinDev Canada’s approach aligned with these recommendations, as we’ve been screening potential transactions and monitoring performance for climate mitigation and adaptation development impact since our inception in 2018. Our work to find and finance projects that support climate change mitigation is more important than ever, such as our investments in renewable energy funds like Climate Investor One and JCM Power that are expected to contribute to 1,200,000 tons and 940,000 tons of avoided GHG emissions in emerging markets through 2040, respectively, in addition to positive social impact and financial returns.

Preventing future risks

As part of its #BuildBackBetter campaign, the World Economic Forum has been encouraging investors to assess climate change-related risks in their investments and strategy to ensure their clients assess and mitigate physical and transition climate risks, as well as to avoid stranded assets.[iii]

In line with our Environmental and Social Policy, FinDev Canada identifies and assesses environmental and social risks, including climate change, and works with clients to ensure those risks have been considered and plans are in place to reduce the likelihood and severity of any negative impact. We rely on performance benchmarks, like the International Finance Corporation’s Performance Standards on Environmental and Social Sustainability, to evaluate climate change and other risks throughout the lifecycle of an investment, keeping an eye on changing conditions in the countries and sectors where we operate. For example, prior to investing in the Africa Forestry Fund, we considered the environmental and GHG emissions risks of the project activities as well as the appropriate mitigants our client has put into place, such as their environmental and social management system and Forest Stewardship Council (FSC) Forest Management Certification commitments.

A jobs-rich, green recovery

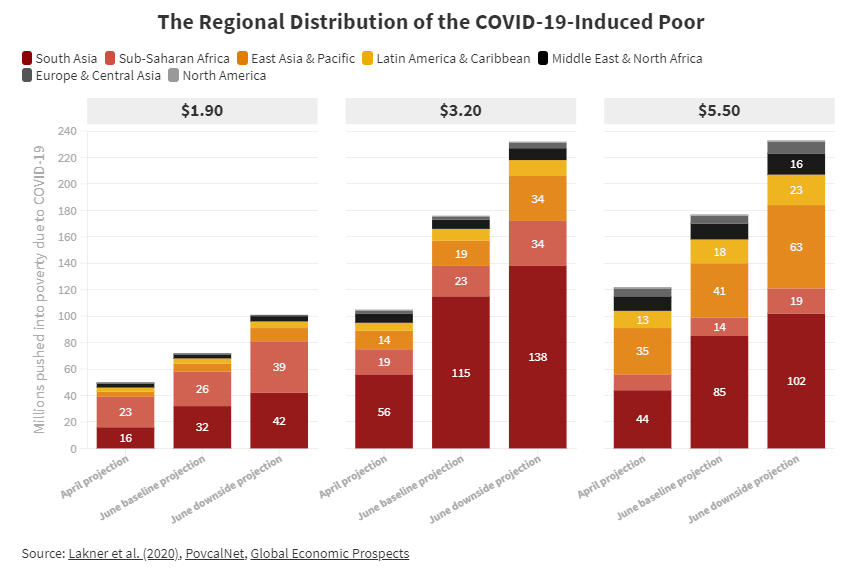

The massive and uneven loss of employment triggered by the COVID-19 pandemic has exacerbated social and economic inequalities and pushed an estimated 71 million people into extreme poverty[iv]. With an estimated 305 million jobs potentially at risk because of the crisis,[v] organizations around the world are calling for a jobs-rich green recovery, including the United Nations Environment Program (UNEP), the World Resources Institute and the World Economic Forum.

From solar lighting to climate-smart agriculture, FinDev Canada’s clients have proven from the start, that protecting nature can create jobs rather than curb them. For example, M-KOPA’s commitment to solar powered lighting solutions and e-waste recycling that aspires to create 2,000 full time and 10,000 sales agent jobs by 2030, a 10-fold increase.

Conclusion

#BuildBackBetter has become the new slogan for governments and policymakers as they work to engineer a post-COVID-19 recovery and start to consider what a post-pandemic world could look like. In fact, many of us are contemplating whether a return to the way things were is actually desirable or if we want to seize this opportunity to reduce global GHG emissions, consider climate risks when deciding where we invest and create jobs in future-proof sectors, like renewable energy and sustainable forestry.

Investors of all kinds, including international finance institutions like FinDev Canada, will play a key role in shaping what post-pandemic recovery programs will look like. We are proud of the fact that our existing policies and practices are already strongly aligned with environmental and social recommendations brought forward by the world’s most notable intellectuals and think tanks as part of #BuildBackBetter discussions, and we commit to put those ideas into action everyday.

[i] http://www.oecd.org/coronavirus/policy-responses/building-back-better-a-sustainable-resilient-recovery-after-covid-19-52b869f5/