Using our capital to bridge gaps in gender-lens investing

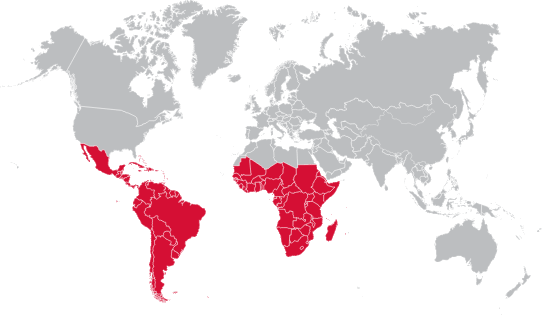

As set out in our Gender Equality Strategy, we will use our capital to bridge gaps in gender-lens investing and deploy capital towards investment opportunities that intentionally and actively drive impact on women’s economic empowerment. In line with our chosen gender lens, we typically define those opportunities as investments in businesses that are owned or led by women, businesses that provide decent work to women, businesses that provide women access to basic services and economic empowerment tools, as well as funds or financial intermediaries supporting these businesses.

Promoting gender action through our investments

Supporting our clients in enhancing their gender inclusion and diversity practices and in driving greater women’s economic empowerment outcomes through their business activities is another key part of our gender-lens approach. Encouraging gender inclusion in companies or industries where it has previously been absent is key if we want to engender change and achieve true equality across the private sector. It is also an asset for growth-oriented businesses, as gender inclusion is correlated with sound business management, better financial and non-financial performance and more innovative teams.

Through FinDev Canada’s partnership with UN Women and our adoption of the Women’s Empowerment Principles, we have established an in-house process with all clients that starts with the completion of the Women’s Empowerment Principles Gender Gap Analysis Tool, a free and strictly confidential business-driven tool developed in consultation with more than 170 companies.

This first step allows us to assess our clients’ current approach to gender equality, identify gaps and opportunities for improvement, and develop a joint strategy with goals and targets to improve their performance when needed. Each client being different, we prioritize action items that are rooted in the client’s context and business activities. In 2020, we will be able to provide technical assistance on gender action to clients through our Technical Assistance Facility.

Leading by example

At FinDev Canada, we want to lead by example when it comes to gender inclusion, and to become an employer of choice for women and men.

Gender parity at FinDev Canada

As of December 31, 2019, women comprised:

57%

of our workforce

40%

of our Senior Leadership team

40%

of our Executive Risk and Investment Committee

56%

of our Advisory Council

45%

of our Board of Directors

Being a catalytic agent of change for gender-lens investing among the investment community

2X Challenge

FinDev Canada, along with DFIs from other G7 countries – the United Kingdom (CDC Group), the United States (Overseas Private Investment Corporation – OPIC), Italy (Cassa depositi e prestiti – CDP), France (Proparco) and Japan (JBIC and JICA), with support from Germany (DEG) – committed to mobilize USD 3 billion by 2020 for investment in business activities that will benefit women.

In 2019, the initiative grew to 14 total members, including development finance institutions and multilateral development banks. Around the time of the 2019 G7 Summit, the 2X Challenge Working Group announced a total of USD 2.5 billion mobilized so far.

FinDev Canada chairs the 2X Challenge for the 2019–2020 term. Out of total capital committed by FinDev Canada in 2019, 56% was placed in 2X-qualifying transactions.

Head of Gender and Impact and former Chair of the 2X Challenge, Anne-Marie Lévesque (third from the left in front), with 2X Challenge representatives, August 2019

Invest2Impact

Head of Gender and Impact and former Chair of the 2X Challenge, Anne-Marie Lévesque (third from the left in front), with 2X Challenge representatives, August 2019

Invest2Impact

Invest2Impact is a 2X Challenge initiative aimed at identifying 100 high-potential women-owned businesses in East Africa to support their access to funding, as well as their business sustainability.

This innovative program, supported by FinDev Canada, CDC Group, Proparco, OPIC and the Mastercard Foundation, began with a major outreach effort across Ethiopia, Kenya, Uganda, Rwanda and Tanzania, followed by four in-country competition roadshows in Addis Ababa, Kampala, Kigali and Dar es Salaam. This opportunity to connect with potential entrants to the competition allowed us to obtain a deeper understanding of the business landscape and support ecosystems in each country.

One hundred participants were selected from 800 applications and allocated into one of four Invest2Impact tracks. Each track is a process that begins once the competition has closed and continues for six to 12 months. Three of these tracks are geared to support access to finance, while the fourth aims to support market competitiveness.

Invest2Impact Competition Winners, December 2019

Collaboration with fund managers through our investments

Invest2Impact Competition Winners, December 2019

Collaboration with fund managers through our investments

“We appreciate that FinDev Canada has encouraged us to elevate a gender-smart approach to our investment process. UN SDG #5 is now a core impact goal for EcoEnterprises Fund. In fact, we count four out of eight companies in our portfolio presently that qualify under the 2X Challenge. Based on additional feedback received from our Impact Committee at a meeting held to discuss gender-lens investment (in which FinDev participated), we integrated women’s leadership and empowerment focus within our environmental and social management tools – from pipeline development, to due diligence, to monitoring.”

Tammy Newmark, CEO and Managing Partner, EcoEnterprises Fund

Promotion of gender-lens investing worldwide

FinDev Canada is constantly engaging with the private and public sector in Canada and abroad to promote gender-lens investing, best practices in terms of women’s economic empowerment and the business case for gender equality as a driver of economic growth.

Gamification as a learning tool

In March of 2019, FinDev Canada launched Unequalopolis, a board game that serves as a learning tool to help players experience the legal and social barriers faced by women around the world that limit their full participation in the economy.

This game is set in a micro-economy where rules are different for men and women. The rules are based on real-life laws and regulations from several countries around the world, backed by data from institutions such as the World Bank, the World Economic Forum (WEF), the Food and Agriculture Organization (FAO), UNICEF and others.

Unequalopolis is played at several national and international events, as well as universities, and is used as a learning tool by peer organizations with a women’s economic empowerment focus.

Unequalopolis play session at HEC Montréal, September 2019

Unequalopolis play session at HEC Montréal, September 2019